Block trading emerged in Brazil from the need of institutional investors to execute large-volume trades with reduced market impact, increased privacy, and under conditions that would not necessarily be absorbed by the central order book in spot market. The purpose of this report is to analyze such trades, its applications, and the profile of this market in Brazil since its launch.

These operations became regulated under CVM Resolution 135 and were admitted for trading on November 27, 2023, by B3, through the Block Trading Solutions. Single Stocks, Units, BDRs, and Real Estate Investment Funds (FIIs) are eligible for block trading, which follows an off-book trading model with central counterparty (CCP).

The Block Trading Solutions are divided into three distinct modalities: Midpoint, BBT - Book Block Trade and RFQ - Request for Quote.

.png)

One can note a significant increase in volume, with ADTV rising over nine times between 2023 and 2025. Nevertheless, the volume includes one outlier transaction — in 2025, excluding a single BRL 1.8 billion block on May 20, 2025, ADTV decreases to 56.7 million BRL, nevertheless, still indicates growth compared to the previous year. As for the percentage of trading sessions with block trades, it remained relatively stable over the first two years, increasing in 2025.

¹ 2023 data equivalent to the months of November and December of this year, the period between the launch of Block Trade Solutions and the end of the year; 2024 comprises all months of the year; 2025 comprehends January to July.

² ADTV stands for average daily traded volume.

³ ADTV of 69.8M BRL comprises all trades in the period, including outliers.

.png)

On average, the number of trades executed daily has increased. When analyzing the daily chart (right), it is evident that this figure is influenced by days with an atypical volume of transactions. It can be said, therefore, that on average, a few days concentrate a large number of trades.

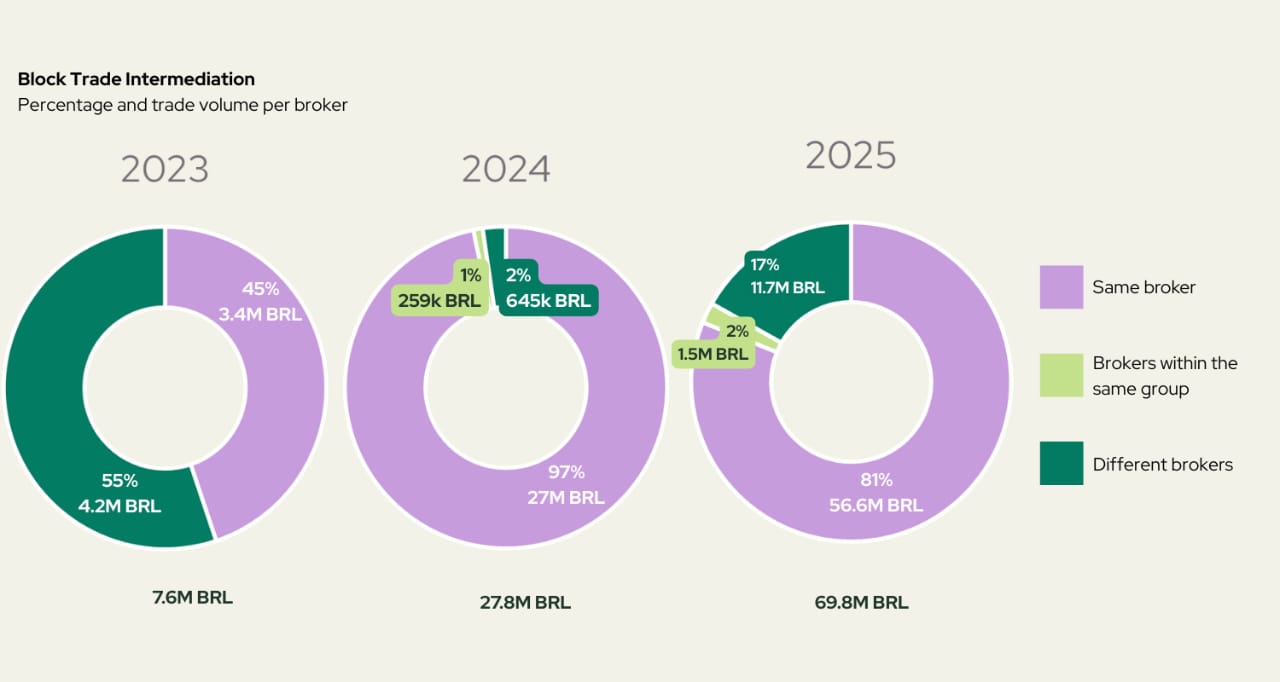

In 2023, block trading volume intermediated between different brokers represented over half the period ADTV. This trend shifted drastically in 2024, when 98% of the volume began to be intermediated by the same broker or the same financial group on both the buy and sell sides. In 2025, this volume drops percentage-wise to 83%, diluted by the significant increase in ADTV; nevertheless, it nearly doubled in absolute financial terms of ADTV.

.jpeg)

In 2023, a significant volume of trades was observed in the midpoint modality. Starting in 2024, however, there is an abrupt decline in trades under this modality, replaced by BBT.

.jpeg)

In 2025, the trend of volume concentration in the BBT modality has continued, gaining larger significance in the analysis of the entire 2023–2025 period. The RFQ – Request for Quote modality, in turn, has not recorded any trades as of the date of this report.

.jpeg)

Analyzing the volume intermediated since the admission to block trading in Brazil, approximately 88% of the volume is concentrated among 5 brokers on both sides of the transactions, that is, buy and sell.